Wanted: Ottawa Homes For Sale

When the calendar rolled over into 2018 many real estate experts across Canada were speculating the housing market to “cool off” with tighter mortgage rules and higher interest rates impacting home buyers. While that may be the case in other real estate markets, in the Ottawa Real Estate market the biggest factor in February’s 2.8% drop in the number of sales (year over year), is that listing inventory is scarce.

“There is no doubt our sales number would have been much higher if we had more properties available for sale. Buyer demand is there, but our inventory in both residential class and condos continues to decline. This is creating a supply side issue in the Ottawa real estate market”

-Ralph Shaw, OREB President

The Ottawa Real Estate board’s recently released statistics show that home buyers are still actively searching for properties in spite of the low inventory, which is a trend that is continuing from 2017. F If the decrease in supply in both the residential and condo markets continues into the Spring, it may put an upward pressure on prices. If you are thinking of selling this is a great time to get your home on the market.

Below we’ve included the latest news release from the Ottawa Real Estate Board. Please note: average sale price information can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The average sale price is calculated based on the total dollar volume of all properties sold. We have access to current statistics and trends in our neighbourhoods and communities, it’s our job to stay on top of the market trends! We have up to date Real Estate Market Reports readily available for you and we love to chat real estate – contact us anytime!

News Release Below: March 5, 2018 Posted by the Ottawa Real Estate Board

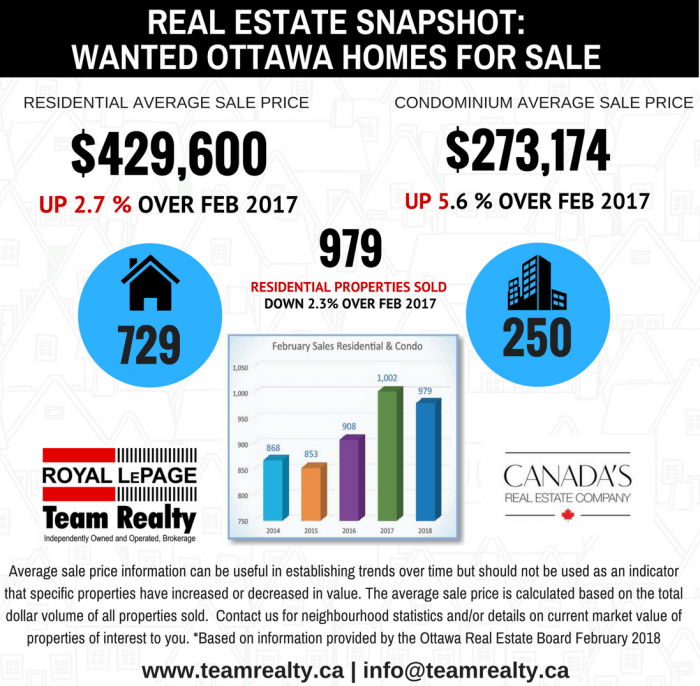

Members of the Ottawa Real Estate Board sold 979 residential properties in February through the Board’s Multiple Listing Service® System, compared with 1,002 in February 2017, a decrease of 2.3 per cent. The five-year average for February sales is 922. February’s sales included 250 in the condominium property class and 729 in the residential property class.

“There is no doubt our sales numbers would have been much higher if we had more properties available for sale. Buyer demand is there, but our inventory in both residential-class and condos continues to decline. This is creating a supply side issue in the Ottawa real estate market,” concludes Ottawa Real Estate Board President, Ralph Shaw. “If this trend continues, the market will move to favour sellers, and buyers will find themselves competing for a limited number of listings.”

“Compounding the supply issue is the fact that after a record year last year, new construction is hindered getting to market because builders just cannot find enough land as a result of the urban boundary and land prices going up,” Shaw points out. “Given this environment, it’s a good opportunity for Sellers to get their property on the market,” he advises.

The average sale price of a residential-class property sold in February in the Ottawa area was $429,600, an increase of 2.7 per cent over February 2017. The average sale price for a condominium-class property was $273,174, an increase of 5.6 per cent from February 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

“The most active price point in the residential market continues to be the $300,000 to $449,999 range, accounting for 47 per cent of the market. While the most active price point in the condo market, between $150,000 and $249,999, accounts for 56 per cent of the market,” Shaw notes.

“The reality is that condo sales are driving the number of properties sold at the moment. Due to demand, the condo market is experiencing some price recovery. Units in the lower price points of the condo market are likely moving rapidly because of the limited supply in the rental market which is yet another factor at play. The lack of availability is essentially forcing renters into condo ownership,” he explains.

“Ottawa is beginning to experience similar indicators that have ultimately led to challenging real estate markets in our larger metropolitan cities. It starts with supply shortages which eventually lead to affordability issues. The city in particular needs to have an intelligent vision about how to support and stimulate all aspects of the market from new construction through to the rental market availability,” Shaw elaborates.

“With this being a civic election year, we look forward to talking with our council and mayoral candidates about what measures need to be taken now to support affordability, before we develop the supply challenges of Toronto or Vancouver,” he cautions.

In addition to residential and condominium sales, OREB Members assisted clients with renting 348 properties since the beginning of the year.